Restaurants in South Africa are still having a hard time to return to pre-Covid-19 degrees of earnings– but it is clear that a pandemic-induced change in consuming routines is playing out in the convenience food industry, which is prospering.

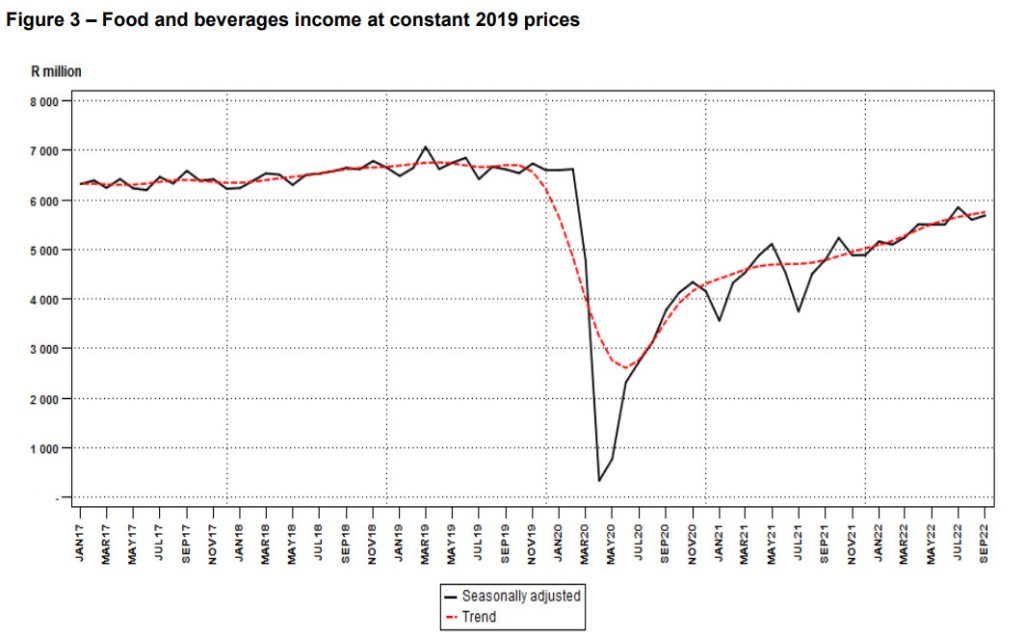

The current food and drinks data from Stats SA reveal that measured in real terms (consistent 2019 costs), complete earnings created by the food as well as beverages market enhanced by 18.6% in September 2022 when compared with September 2021.

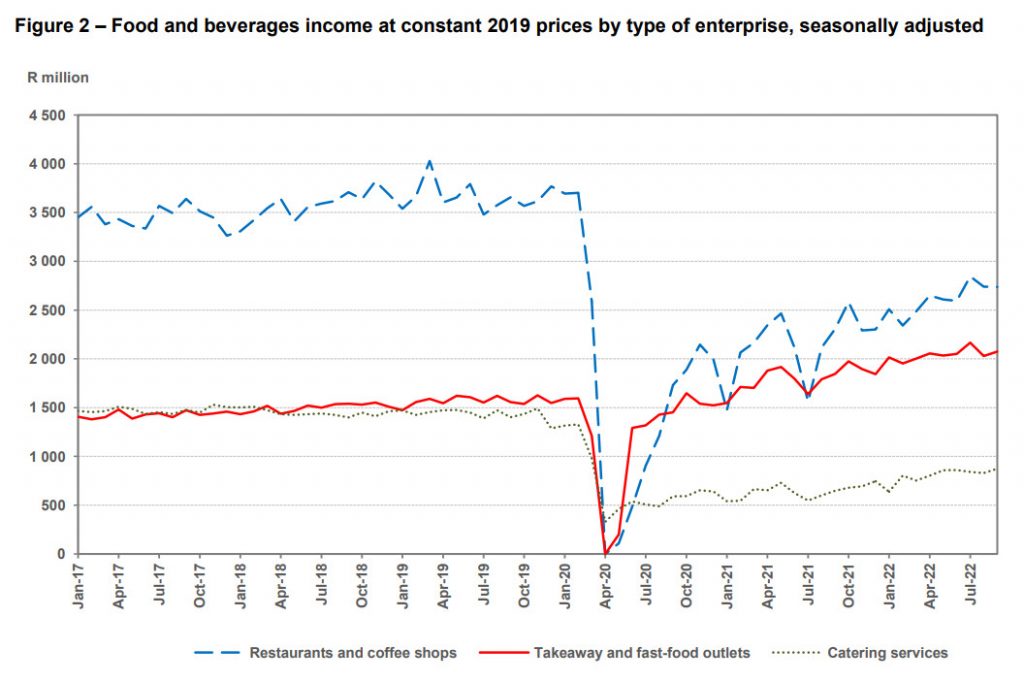

While the primary contributor to the 18.6% year-on-year increase still originates from dining establishments as well as coffee shops, the sector is still some way off from levels seen prior to the Covid-19 pandemic in 2020/2021.

Fast food, while a general smaller contributor to the industry, has quickly gone back to typical and also even went beyond those previous degrees.

The sector overall is revealing a rocky path to recuperation. Complete sales recorded in September 2022 went to R5.6 billion, only 85% of the R6.5 billion tape-recorded in September 2019, yet this is still showing a general trend upwards.

Dining establishments pulled in R2.6 billion in September, down slightly from August, while junk food and takeaway business videotaped earnings of R2 billion for the month.

Food and restaurant sales are likewise enhancing income in relevant sectors, with the holiday accommodation market likewise reporting R630 million in sales as part of its R3.9 billion haul for the month.

Huge shifts

South Africa is seeing a wider shift to convenience foods as well as quick solution dining establishments as well as takeaways– a trend which has actually not gone unnoticed.

Analysts have actually indicated a growing ‘architectural’ pattern in the direction of a higher take-away/fast food/convenience society in the nation, which was likely increased by the improved shipment capacity of numerous electrical outlets throughout the Covid-19 pandemic.

Post-Covid 19 lockdowns, consumers appear to be far keener on ease as well as speed, and take-away/fast food electrical outlets cater extra for this.

While some of the shift is being driven from a service perspective, consumers are additionally under raising economic stress because of financial headwinds, which make them far more critical when it comes to exactly how as well as where they spend their money.

According to FNB planner John Loos, unfavorable financial events are beginning to force customers to reprioritize their budgets– partly at the expenditure of eating in restaurants.

” These (economic) occasions include increasing general inflation, particularly in the location of petrol rates, in addition to climbing interest rates, and also a reducing economy constraining home income growth,” he claimed.

Warning

In spite of a much more low-key showing for dining establishments and also cafe, the Bureau for Economic Study’s (BER) evaluation of third-quarter data for the field shows that the hospitality market, in general, gets on the course to healing as well as is expected to proceed along this line right into 2023.

The last quarter of the year is typically a solid entertainer for the industry, offered the elevated number of visitors and also vacationers making their means to numerous parts of the nation, together with joyful season investing over Black Friday as well as the holidays.

Nevertheless, there are some warnings, according to Nedbank economists.

Information released by Statistics SA previously in November showed that actual retail sales contracted by 0.6% year on year, compared to development of 2.1% in August. This efficiency was weak than market forecasts which shows that South African consumers remain under pressure.

” Retail trade will certainly pick up relative to September in the months ahead as customers benefit from Black Friday specials and also keep higher degrees of spending throughout the joyful season,” the bank claimed.

” Volumes are, nevertheless, unlikely to be considerably greater than in the same duration in 2021 as the difficulties of greater prices, dismal labour markets as well as tighter economic conditions squeeze disposable earnings as well as weigh on consumer belief. These conditions will certainly remain to wet retail sales in the new year.”